If you’re new to Forex trading and struggling, using a technical solution to handle everything might seem like an appealing idea. Forex trading bots or robots are becoming increasingly popular, promising to ease the burden for traders. For those looking to get started with automation, an affordable forex robot coding service can be a great way to implement tailored strategies without breaking the bank. In this article, we will analyze the advantages and disadvantages of using them.

What is a Forex Robot?

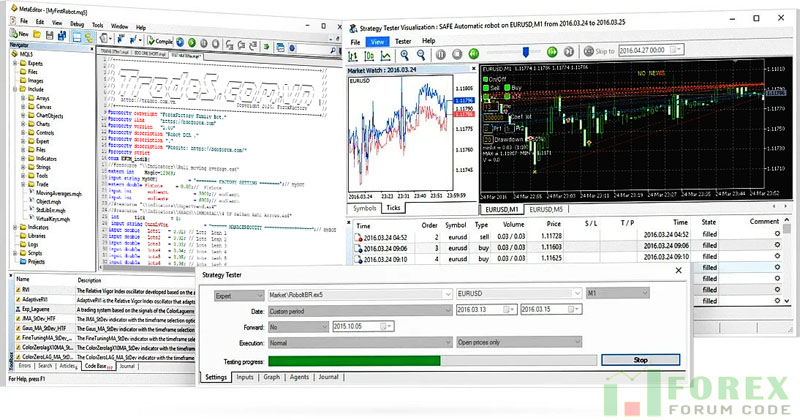

Forex Robots (also known as Expert Advisors – EAs) are software programs that automatically trade on the forex market based on pre-programmed algorithms and strategies. These robots operate on platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), using the MQL4/MQL5 language to analyze the market and execute buy/sell orders without manual intervention.

Forex bots are often programmed to analyze market signals, including both technical and fundamental analysis, to decide when to buy or sell. Trading strategies can be built based on various factors, including market trends, price volatility, and technical indicators.

The advantages of using Forex Bots include the automation of trading processes, reduced risk from emotional influences, improved trading performance, and time savings. However, it’s important to note that using Forex Bots requires the necessary knowledge and skills to set up and manage them effectively.

For example, a robot can automatically sell the EUR/USD pair when the price hits a resistance level, helping eliminate emotions and save time. Forex Robots are suitable for both beginners and professional traders.

Pros and Cons of Using Forex Trading Robots

Advantages:

- Automated Trading: Forex trading robots automatically execute buy and sell trades based on pre-programmed algorithms. This minimizes human intervention and removes emotional factors, increasing consistency and risk management capability.

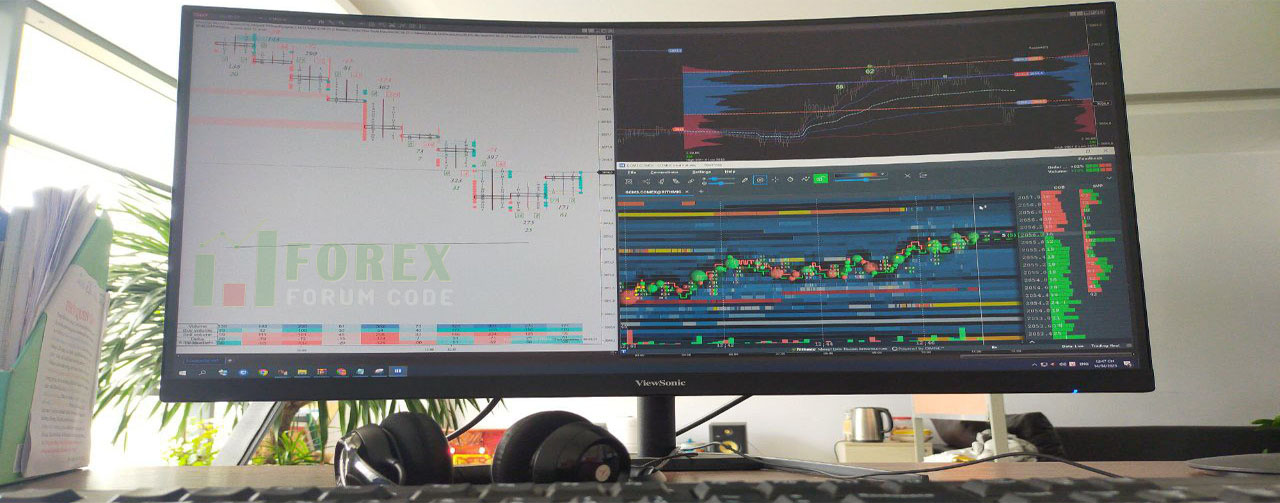

- Enhanced Performance: Trading robots can analyze the market quickly and continuously 24/7 without fatigue or distraction, which can enhance trading performance and optimize profits.

- Emotion-Free Decision Making: One of the main benefits of using trading robots is completely removing emotions from trading decisions. This avoids biased or emotionally driven decisions, ensuring trading consistency.

- Time-Saving: Using trading robots saves traders time by automating trades without needing to constantly monitor the market.

Disadvantages:

- Market Dependence: Trading robots may perform well under specific market conditions but may not react properly to high volatility or sudden changes.

- Technical Risks: Trading bots may be affected by configuration or technical errors, leading to inaccurate trades and potential risks.

- Initial and Maintenance Costs: Some trading robots can be expensive and require ongoing maintenance costs, including software updates and support services.

- Need for Knowledge and Skills: While trading robots automate processes, users still need knowledge and skills to install and manage them effectively.

How to Use Forex Trading Robots and Who Should Use Them

Using forex trading robots can be suitable for specific groups, including:

- Beginners: New traders often struggle with understanding and applying strategies. Trading robots can be a reasonable option as they automate trades based on preset algorithms, reducing the need for analytical skills.

- Knowledgeable but Busy Traders: Experienced traders may want to automate their strategies, which is helpful for those with busy schedules and little time to monitor markets.

- Those Looking to Reduce Risk and Emotions: A key benefit of trading robots is removing emotional influence. Robots aren’t affected by fear or panic, helping reduce risk and ensure strategy stability.

However, note that trading robots are not suitable for everyone. Some downsides include:

- Technical Factors: Installing and running trading robots requires technical knowledge and programming skills. It may be difficult or time-consuming for those without experience.

- Technical Risks: Although programmed to follow specific rules, robots can still face technical risks such as software bugs or incorrect algorithm decisions.

- Costs: Some trading robots require usage fees or licenses, which may increase trader expenses.

How to Use a Forex Robot

- Choose a reputable robot: Search on MQL5 Marketplace or services like Trades.com.vn. Check reviews and trading history via Myfxbook.

- Install the robot: Integrate it into MT4/MT5, set up the currency pair, time frame (M15, H1), and risk parameters.

- Use a VPS: Ensure 24/7 operation with a VPS (e.g., HostingViet, from 65,000 VND/month).

- Backtest: Test performance on demo accounts or historical data.

- Monitor: Track and adjust the robot to match market conditions.

- Money management: Set risk per trade below 1–2% of the account.

Who Should Use Forex Robots?

- Beginners: Support automation, reduce analysis pressure.

- Busy traders: Benefit from 24/7 trading without constant monitoring.

- Investors seeking optimization: Remove emotions, execute precise strategies.

- Scalping traders: Suitable for short-term strategies.

Note: Always test robots on demo accounts before using real money. See more guidance on choosing Forex robots.

Popular Types of Forex Robots

- Auto Trading Robot: Fully automated, ideal for those wanting time-saving solutions.

- Scalping Robot: Short-term trading, exploiting small price movements.

- Semi-Automated Robot: Provides signals; traders make the final call.

- HFT Robot: High-frequency trading; be aware of broker policies.

See more: Comparison of Forex robot types.

How to Optimize Forex Robots

- Thorough backtesting: Use historical data to evaluate performance.

- Parameter customization: Adjust indicators (RSI, MA) or time frames.

- Use a quality VPS: Ensure stable connectivity.

- Frequent updates: Tune robots to market trends.

Suggested image: Forex robot backtest chart (alt text: “Forex robot backtest results on MT4”).

Notes When Using Forex Robots

- Don’t rely entirely on them: Robots are tools, not a substitute for experience.

- Risk management: Limit risk to 1–2% per trade.

- Avoid overhyped ads: Verify performance via Myfxbook.

- Understand the strategy: Know the robot’s algorithm before use.

Best and Affordable Forex Robot Coding Service Today

- The Forex bot coding service by Budacode.com is rated as one of the top solutions in this field. With a team of experienced experts and deep knowledge of the forex market, Budacode.com promises to deliver optimized Forex bots for traders.

- A key strength of this service is its high customization, allowing clients to participate in the design and development process based on their specific strategies. This ensures that the bot is perfectly optimized for individual trading goals.

- Additionally, Budacode.com offers professional support and maintenance services, ensuring the bot always runs smoothly and efficiently. This brings peace of mind and reliability to clients using their services.

- In short, Budacode.com’s Forex bot service not only offers flexibility and high performance but is also highly regarded for professionalism and customer support.

Custom Forex Bot Development Based on Client Strategy

Specializing in all services on MetaTrader platforms, including converting trading strategies into EA Bots, editing, upgrading existing bots, and converting bots between programming languages…

✅ Deliver and backtest bots as requested.

✅ Ensure bots follow the client’s exact strategy.

✅ Ultraview and direct calls for test guidance after bot delivery.

We specialize in MetaQuotes Language programming.

✅ Can handle 99% of client-proposed strategies.

✅ Support updating bots to match new strategies.

✅ We also develop bots that send signals from MT4 to Telegram.

Affordable forex robot coding service

[+] Zalo: https://zalo.me/0332338336

[+] Telegram: https://t.me/@tony_ntp

----------------------------------------------

Price : 86u

[+] For complex features, the price is negotiable.

:

:

Thank you very much for your support in the past time.